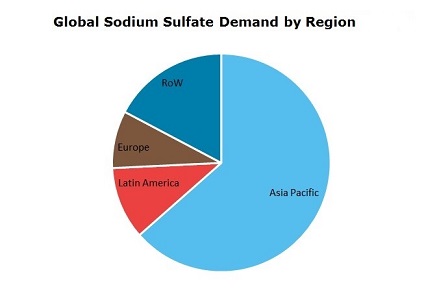

Sodium Sulphate Market size will witness a significant growth, owing to rising application of product in soaps and detergents over the forecast period. Upsurge in production of dry form detergents will add to sodium sulphate market size. Increasing consumption of dry detergent powder over liquid detergent is the major driving factor for product market growth. Sodium sulfate is a naturally inorganic compound and can be obtained as a by-product through industrial processes of commercial hydrochloric acid. It is commercially traded in three forms; Glauber’s salt, salt cake and niter cake in international market. Rising demand of dyeing application in textile industry will propel the product market growth in forecast time frame. Sodium sulphate owing to non- corrosive property can be used as an alternative of sodium chloride for coloring application. It helps in reducing negative charges on fibers so that dyes can penetrate evenly. Extensive application scope as a chemical ingredient in the chemical industry as well as animal feeding stuff will further drive the product demand. Increasing adoption of the product in glass manufacturing industries expected to boost product demand over forecast period. It is extensively used as a fluxing agent in glass manufacturing industry. Surge in product application for blowing and casting processes to eliminate small air bubbles and deficiencies will further support the sodium sulphate market size. Sodium sulphate notable application in Kraft process of wood pulp manufacturing will also drive the product demand. Asia Pacific region is the major consumer of the product and demand continue to rise in forecast period owing to increasing population in countries such as Japan, China, India and Indonesia. The demand is driven by growing textile industry Japan, where approximately more than 100 KT of sodium sulphate is utilized annually by textile manufacturers. China is one of the largest producer of the product and domestic demand is growing at a significant rate. Pulp and paper industry in India is one the major consumer of the product and demand is anticipated to grow significantly over the forecast period. North America led by Mexico is anticipated to provide strong business opportunities for the product owing to surge in application of soap and detergents over forecast period. Demand for cleaning product is stable but with changing demographic trends consumer needs for more convenience-oriented products will probably stimulate product market growth. European market also plays a key role in the overall sodium sulphate market as region accounts for a major share in the global production capacity. Detergent industry is one of the largest consumer of product in the region. Further chemical industry, textile industry, glass industry, and paper industry propel demand for the product. Sodium sulphate market is developed and production is sufficient to meet domestic needs. However, demand for product will further grow as the product is widely used as an alternative to other expensive ingredients in manufacturing industries. MEA led by Turkey have high growth potential for the production of natural sodium sulphate. Surge in production capacity in the region will augment the product market size over the forecast period. Shift in consumer preference from soap bars to powder detergents in the region will further drive the sodium sulphate market size.

Recently, China has resumed work and production, but in many regions, the chemical industry has witnessed a price hike. According to reports, vegetables, fruits, building materials, electronics, consumer products, chemical and other industries across the country have seen skyrocketing growth, from 10%, 20%, 50%, 100% to more than 1200%. Titanium dioxide rises by 500 yuan/ton Jinhai Titanium Industry issued a price adjustment letter saying that domestic traders in China have raised their prices by 500 yuan/ton, and foreign traders have raised their prices by 80 dollars/ton. Earlier, the titanium dioxide giant China Nuclear Titanium Dioxide also issued a price adjustment letter saying that since February 26, the sales price of various types of titanium dioxide based on the original price, domestic users: up 500 yuan/ton, international users: up $ 100/ton. In mid-February, Venator (a Huntsman subsidiary), the world's third largest titanium dioxide producer, announced that it will raise prices globally for all titanium dioxide products used in coatings, plastics, inks and paper. Among them, Asia Pacific and the Americas will raise prices by 120 dollars/ton after March 1. In Europe, the Middle East and Africa, prices will increase by 100 euros/ton or 120 dollars/ton after April 1. Affected by COVID-19, the latest offer of Long Mang Baili Lian Group's rutile-type titanium dioxide was raised by 500 to 16,200 yuan/ton. Polyvinyl alcohol rises by 200 yuan/ton Anhui Wanwei High-tech Materials issued a price adjustment notice saying that since 8 o'clock on February 27, Wanwei, Mengwei and Guangwei: the price of all flake series products increased by 200 yuan/ton. Vitamin prices rise by 40% On February 17, some Chinese manufacturers raised the price of 80% B2 products to 140 yuan/kg, an increase of 40% compared with the previous average price of 100 yuan/kg. The prices of K3, biotin, B1 and other varieties have also risen sharply. K3 (MSB) is currently quoting 70-75/kg, which is 55 yuan/kg higher than the price of Veneda MSB a year ago, an increase of about 30%. The latest price of 2% biotin is 300-350 yuan/kg, but 158-180 yuan/kg before the holiday. The latest market price of VE is 60-65 yuan/kg, but the price before the holiday is 47-50 yuan/kg. The industry insiders said that the vitamin industry's supply and demand pattern is special: 70-80% of vitamin production capacity is in China, but about 70% of consumption is abroad. The epidemic situation has led to postponement of resumption of work. The time of work resumption, the impact of logistics and transportation, and the trend of the epidemic are all uncertain. These comprehensive factors have led to the general rise in vitamin products. The price of vitamins has generally risen, and the major segment leaders have great price elasticity, and profits are expected to increase. 23 feed factories raise prices, an increase of 100 yuan/ton After the resumption of work, the breeding industry started a wave of price hikes. 23 feed mills raise prices, and the cost of breeding further increased. During the epidemic, due to travel restrictions, the price of crop products began to rise, and the prices of soybean meal, corn, and wheat bran skyrocketed. Villages and roads are closed everywhere, resulting in insufficient transportation capacity and substantial increase in logistics costs. In some places, freight rates have risen by 30%. Raw materials have risen, freight rates have risen, and feed factories have been unable to withstand it. As soon as they resumed work, 23 feed mills began issuing price increases. The price of pig feed basically increased by 100 yuan/ton, and the price of chicken and duck feed basically increased by 50 yuan/ton.

There are two ways for national chemical companies in developing countries to catch up: First, start from the petrochemical plant of large, big companies themselves in a cycle of average profit to maintain in the billions of dollars, which have strength step by step in the direction of high precision pointed special material development. Second, as China is a manufacturing power, many industries, such as panels, chips and electric vehicles, have been gradually transferred to China. Enterprises in related industries can directly take specialty chemicals as their main business to catch up. Despite the great challenges, it also provides chances. At present, with the success of some enterprises represented by Wanhua Chemical and private large-scale refinery in the petrochemical field, the local chemical industry leaders will also have the revenue volume close to that of overseas giants. If China can no longer maintain the high growth mode driven by real estate investment, then China needs to consider the reality of where the local chemical enterprises, which have been driven by local market demand in recent years, will go in the next stage. The breakthrough of China’s chemical industry in massive and high-barrier products has come to an end, but there are still shortcomings. As early as 2010, China’s output value of chemicals surpassed that of the United States and became the world’s largest. In 2014, China’s output value of chemicals surpassed that of the United States and Japan, the second and third largest countries combined. The main logic is that the rapid growth of the Chinese market is driving the transfer of basic chemicals and general materials to domestic production capacity. With the concentrated outbreak of engineers’ bonus and the counterattack of domestic equipment manufacturing industry, it is natural for the technology autonomy after reverse development. Domestic enterprises have made breakthroughs in many large and high-barrier varieties such as MDI, PC, titanium dioxide chloride and egg-laying acid. But look at China’s trade deficit: every year, China needs to import synthetic materials of $75 billion and $37 billion high-end chemicals. Although some are caused by the resource endowment, in most of the high performance composite materials, semiconductor materials and other specialty chemicals areas, they are still one of the shortcomings and the key breakthrough in the chemical industry. From the status quo of R&D investment, the two directions of the rise of local enterprises are as follows. Overseas, multinationals have refocused on higher-margin niches after hitting growth limits. In the future, the battle between emerging market players, including Chinese companies, and multinational companies, will shift to specialty chemicals across the board. If we observe from two dimensions, one is the absolute scale of R&D investment. The front-line leaders of each sub-industry represented by Wanhua Chemical are breaking through the boundary of specialty chemicals field and making an impact on global giants through diversified transformation. Second, enterprises with relatively high R&D expenses, namely the leading force in the new materials industry, are expected to emerge as invisible champions in subdivided fields as the downstream application scenes, such as panel display, semiconductor and 5G, are transferred to domestic production capacity. Top-level design promotes the transfer of overlapping downstream application scenarios, and China’s chemical industry enters the innovation-driven era. From the perspective of policy, the new material industry has been the development direction supported by China for many years, and the selection of new chemical materials after the launch of science and technology innovation board has become an important driving force for China to “strengthen its weaknesses” and promote industrial upgrading. In addition, with the application scenarios of downstream semiconductor, panel display and lithium battery industry gradually transferred to China, and 5G industry taking the lead in the Chinese market, the import and replace of electronic chemicals in related fields is expected to accelerate, and China’s chemical industry is about to enter a new era driven by innovation.

On January 14, 2020, the General Administration of Customs of China released the Initiative on “Smart Customs, Smart Borders and Smart Connectivity” at the Press Conference held by the State Council Information Office. As China Customs’ official paper elaborating on its cooperation vision of “Smart Customs, Smart Borders and Smart Connectivity”, this Initiative advocates adoption of innovative measures and application of new-generation technologies to achieve smarter customs control, smarter customs governance and smarter customs cooperation, and enhance connectivity among all parties in the international supply chain, thus enabling the country’s Belt and Road Initiative to deliver more tangible outcomes.